What happens if a drone crashes into your property? Who is liable if someone is injured during filming? These are not hypothetical scenarios; they are critical risks that can expose your business to significant financial and legal damage. This is precisely why engaging a fully insured drone operator uk is not just a best practice-it’s an essential safeguard for your project, your reputation, and your finances. Hiring an operator based on a low price alone could end up costing you thousands in unforeseen damages and liability claims.

But how can you be certain an operator’s insurance is legitimate and sufficient for your specific needs? Navigating the complexities of commercial liability, aviation regulations, and policy verification can be a daunting task. This comprehensive guide is designed to provide you with complete peace of mind. We will break down exactly what to look for, the key questions you must ask, and how to confidently verify that you are partnering with a truly professional and compliant operator, protecting your business from risk and ensuring a safe, successful project from start to finish.

Key Takeaways

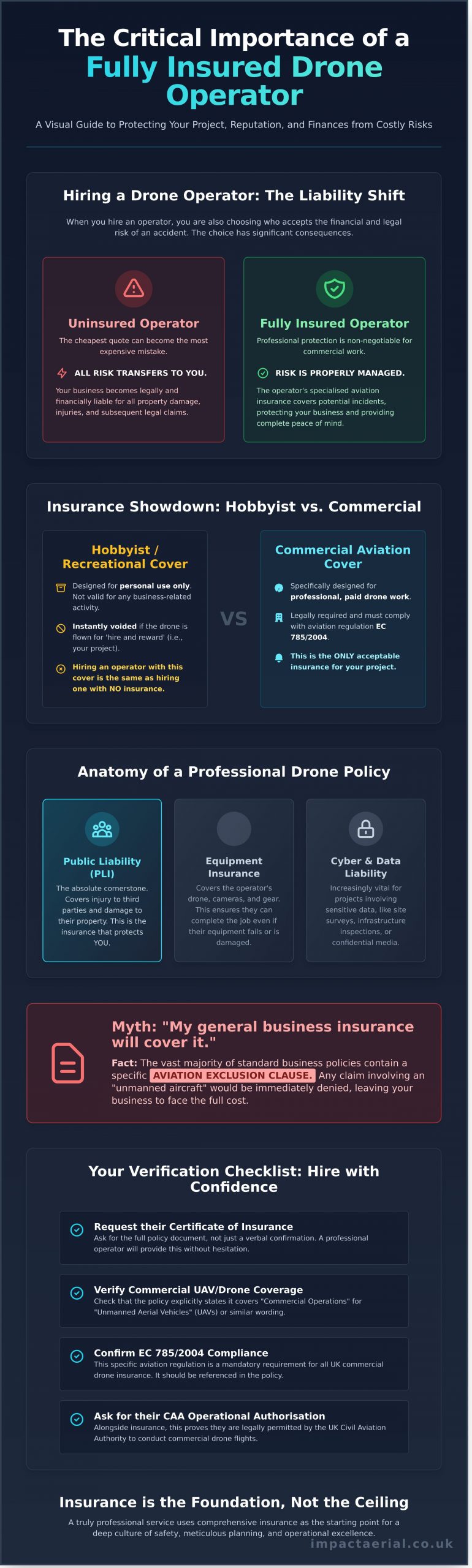

- Understand that if you hire an uninsured operator, your business becomes legally and financially liable for any accidents, property damage, or injuries.

- Learn the critical difference between basic recreational cover and the robust commercial liability insurance required for any professional drone work in the UK.

- Discover the specific documents and CAA certifications you must request to confidently verify you are hiring a fully compliant and insured drone operator uk.

- Recognise that comprehensive insurance is the foundation, not the ceiling, of a professional service that prioritises a deep culture of safety and operational excellence.

What ‘Insured Drone Operator’ Means for Your Project’s Safety

When you hire a professional for aerial work, the term ‘insured drone operator’ is more than just a reassuring buzzword; it’s a critical component of your project’s financial and legal security. It signifies that the operator holds a specialised commercial insurance policy designed specifically for aviation activities. This is a non-negotiable legal requirement for any commercial drone work in the UK, providing a vital safety net against unforeseen accidents. Without it, you, the client, could be exposed to significant liability.

To better understand the specifics of this coverage, this short guide provides a clear overview:

Commercial vs. Hobbyist Insurance: A Critical Distinction

A fundamental mistake is assuming any drone insurance will suffice. Hobbyist or recreational policies are designed purely for personal use and are immediately voided if the drone is flown for ‘hire and reward’. A professional, insured drone operator in the UK must carry a commercial policy that explicitly covers business activities. Hiring an operator with the wrong insurance is the same as hiring one with no insurance at all, leaving your project completely unprotected.

Key Coverage Types Explained Simply

Commercial drone insurance is not a single product but a package of protections. The most important one for you as a client is:

- Public Liability Insurance (PLI): This is the cornerstone of commercial drone operations. It covers costs associated with injury to third parties or damage to their property. All commercial operators must hold PLI compliant with EC 785/2004, a standard mandated by the comprehensive UK drone regulations.

- Equipment Insurance: This covers the drone, cameras, and other gear. While this is primarily the operator’s risk, it ensures they can continue work in the event of equipment failure.

- Cyber & Data Liability: An increasingly vital cover for projects involving sensitive data capture, such as site surveys or infrastructure inspections.

Why Your Own Insurance Won’t Cover Drone Incidents

It is a dangerous assumption that your company’s general business or public liability insurance will cover an incident involving a drone. The vast majority of standard commercial policies contain specific exclusions for aviation activities and unmanned aircraft. Attempting to claim on your own policy would almost certainly result in denial, leaving your business liable for all costs. By hiring a properly insured drone operator, you correctly transfer this specialised risk to their insurer, providing essential peace of mind.

The Real Risks: What Happens When You Hire an Uninsured Operator?

While professional drone operations are meticulously planned to be safe, the potential for accidents due to technical malfunction or unforeseen environmental factors can never be completely eliminated. Choosing an uninsured operator transfers the enormous financial and legal risk directly onto you and your business. The savings of a cheaper, non-compliant quote are insignificant compared to the catastrophic costs of a single incident.

Understanding these real-world consequences is crucial for any business looking to leverage aerial data. Let’s explore what is truly at stake.

Scenario 1: Property Damage During a Survey

Imagine you have commissioned a drone to survey a commercial building’s roof. Mid-flight, the drone loses signal and collides with the building, damaging expensive cladding and smashing a series of high-level windows. Without operator insurance, the liability for the repair costs-potentially running into tens of thousands of pounds-falls directly on you as the client. A certified and insured drone operator uk carries robust Public Liability Insurance (PLI) specifically to cover these events, protecting your assets and ensuring repairs are handled without any financial impact on your business.

Scenario 2: Third-Party Injury at a Public Event

Consider a drone being used to film your corporate event or a local festival. If the aircraft fails and falls into a crowd, the consequences escalate from property damage to severe personal injury. This opens your business up to significant personal injury claims, protracted legal battles, and compensation awards that can be financially crippling. The subsequent negative press can also cause irreparable damage to your brand’s reputation. When the operator is uninsured, it is often the client who hired them that faces the full force of legal action.

Who is Legally Liable? The ‘Hirer Beware’ Principle

In the UK, the responsibility for ensuring a drone operation is compliant does not rest solely with the pilot. By engaging a non-compliant operator, you, the client, assume a significant portion of the risk. Failing to perform due diligence and verify that your chosen provider meets the legal Civil Aviation Authority insurance requirements can be viewed as negligence. In the event of a serious incident, the CAA may investigate your hiring process as well as the operator’s actions. This principle of ‘hirer beware’ underscores why working with a professional, fully insured drone operator in the UK is an non-negotiable part of project risk management.

Ensure your project is protected. Speak to our insured experts.

Decoding Drone Insurance in the UK: A Checklist for Clients

Verifying an operator’s insurance is more than just ticking a box; it’s a critical step in your due diligence process. A professional operator will readily provide their insurance certificate, but knowing what to look for is essential for your protection. To ensure you partner with a genuinely insured drone operator uk, use this checklist to assess their documentation and confirm their coverage is both valid and appropriate for your project.

Public Liability Limits: Is £1 Million Enough?

While the minimum Public Liability Insurance (PLI) for commercial drone operations is set at approximately £1 million, this level is rarely sufficient for professional, industrial, or commercial projects. For added peace of mind and comprehensive protection, the industry standard for high-value work, such as on construction sites, for asset inspections, or near public spaces, is typically £5 million or £10 million. Always ensure the operator’s cover limit matches the potential risks of your specific project.

What is EC 785/2004 Aviation Compliance?

This is the most critical detail to find on an insurance certificate. EC 785/2004 is a specific aviation regulation, adopted by the UK, that governs insurance for air carriers and aircraft operators. Standard public liability policies do not cover aviation activities. Any policy that is not compliant with this regulation is invalid for commercial drone work. This isn’t just a recommendation; it’s a legal mandate outlined in the official Civil Aviation Authority insurance requirements. The presence of this clause is a key indicator of a specialist, legitimate policy.

Checking the Policy’s Fine Print: What to Look For

When you receive an insurance certificate, don’t just file it away. Take a moment to perform these simple but vital checks. An authentic insured drone operator uk will have a policy that clearly states the following:

- The Insured’s Name: Does the company or individual name on the policy match the operator you are hiring? Discrepancies here are a major red flag.

- Policy Dates: Check the “effective from” and “expiry” dates to confirm the policy is current and will be valid for the entire duration of your project.

- Coverage Level: Verify that the stated Public Liability limit meets your project’s requirements (e.g., £5 million or £10 million).

- Aviation Compliance: Look for explicit mention of “EC 785/2004” to confirm it is a valid aviation-specific policy.

How to Confidently Verify an Operator’s Credentials

Understanding the importance of insurance is the first step; verifying it is the crucial next one. A truly professional and compliant operator will be transparent and readily provide documentation for your peace of mind. This practical guide will empower you to confidently assess an operator’s credentials before any work begins, ensuring you hire a legitimate insured drone operator UK businesses can rely on.

Step 1: Ask for the Certificate of Commercial Insurance

Any legitimate drone company will provide their Certificate of Commercial Insurance without hesitation. When you receive the document, take a moment to review the key details. First, ensure the business name on the policy matches the company you are hiring and cross-reference it with their website. Check that the policy is current and has not expired. Most importantly, the policy must explicitly cover commercial operations using ‘Unmanned Aerial Vehicles’ (UAVs), ‘Unmanned Aircraft Systems’ (UAS), or ‘Drones’.

Step 2: Request the CAA Operational Authorisation

Alongside insurance, the operator must hold a valid Operational Authorisation from the UK’s Civil Aviation Authority (CAA). This is the official legal permission required to conduct commercial drone flights, and it is a critical piece of the compliance puzzle. In fact, most specialist insurance policies are rendered invalid if the operator does not hold this authorisation. The document will clearly state the registered operator’s name and their unique CAA authorisation number.

Red Flags to Watch Out For

Your due diligence protects your project, your property, and your reputation. Be alert for these common warning signs that suggest an operator may not be compliant or properly insured:

- Reluctance to Provide Documents: A professional will have their insurance and CAA authorisation ready. Hesitancy or outright refusal is a major red flag.

- Unusually Low Prices: Professional insurance, equipment, and certification are significant business costs. A quote that is dramatically lower than others may indicate these essential overheads have been skipped.

- Vague or Evasive Answers: Questions about insurance limits, CAA status, or safety procedures should be met with clear, confident answers.

- Lack of Professional Presence: A missing or unprofessional website, no registered company details, or a lack of a portfolio can suggest a hobbyist rather than a certified commercial professional.

By following these steps, you ensure you are partnering with a credible and fully insured drone operator. At Impact Aerial, we pride ourselves on transparency and are always prepared to provide our full documentation for client review.

Beyond Insurance: Hallmarks of a Truly Professional Drone Service

While comprehensive commercial insurance is the non-negotiable foundation for any drone operation, it represents the baseline, not the complete picture of professionalism. A truly reliable and safe service is built upon a much broader culture of safety, compliance, and operational excellence. Choosing a properly insured drone operator uk is the first step; verifying their qualifications, planning procedures, and experience is what guarantees a successful and risk-free project.

These additional hallmarks are what separate a true specialist from a simple hobbyist with a policy. They demonstrate a deep-seated commitment to not only protecting your interests financially, but to proactively preventing incidents from ever occurring.

CAA GVC Certification: The Pilot’s Licence

In the UK, the key pilot qualification is the General Visual Line of Sight Certificate (GVC). This certification is a prerequisite for any operator applying to the Civil Aviation Authority (CAA) for an Operational Authorisation, which is required for most commercial work. Hiring a GVC-certified pilot provides assurance that they have been rigorously trained and tested on UK air law, flight planning, and critical safety procedures, ensuring a high standard of operational competence.

The Importance of Risk Assessments (RAMS)

A professional operator never arrives on-site and simply launches their drone. Every commercial flight is preceded by meticulous planning, including a detailed site survey and the creation of a Risk Assessment and Method Statement (RAMS). This crucial process involves:

- Identifying all potential on-site hazards (e.g., public access, power lines, buildings, air traffic).

- Assessing the level of risk associated with each hazard.

- Defining clear, actionable steps to mitigate those risks and ensure a safe flight.

For complete peace of mind, you should always feel confident asking a potential operator to share an example of their RAMS documentation.

Why Experience Matters

A certificate proves theoretical knowledge, but only real-world experience builds true expertise. An experienced operator has the practical skills to manage dynamic situations, adapt to unexpected challenges like sudden weather changes, and understand the unique complexities of different environments, from busy construction sites to sensitive ecological surveys. This background ensures not only safety but also greater efficiency and higher-quality data collection. An experienced, insured drone operator uk transforms a potential risk into a reliable asset for your project.

These elements-robust insurance, official certification, meticulous planning, and deep industry knowledge-are what define a professional partner you can trust. Our team combines £5m insurance with years of industry experience, providing the comprehensive peace of mind your project deserves.

Your Final Check: Partnering with a Vetted and Insured Drone Operator

Hiring a drone operator in the UK is a decision that carries significant weight for your project’s safety and success. As we’ve explored, the distinction between a professional and an amateur lies in verifiable credentials. The key takeaways are clear: comprehensive insurance is non-negotiable for mitigating risk, and diligent verification of an operator’s CAA certification and policy documents is essential due diligence. Ultimately, selecting the right insured drone operator uk is about securing more than just aerial footage-it’s about ensuring compliance, safety, and total peace of mind.

At Impact Aerial, we provide this assurance as standard. Our pilots are all CAA GVC Certified and backed by £5m in Commercial Liability Insurance, offering professional services with nationwide UK coverage. Don’t leave your project’s outcome to chance. Protect your project. Request a quote from our fully insured and CAA-certified team today. Make the safe, professional choice and let’s achieve breath-taking results together.

Frequently Asked Questions

Is drone insurance a legal requirement for commercial operators in the UK?

Yes, it is an absolute legal requirement. Any individual or company operating a drone for commercial purposes in the UK must hold valid commercial drone insurance that complies with the EC 785/2004 regulation. This is not optional and applies to all commercial flights, regardless of the drone’s size or weight. Operating without this specific aviation insurance is illegal and carries significant penalties, highlighting the importance of verifying your chosen operator’s credentials before any work commences.

What is the minimum level of public liability insurance a drone operator must have?

The minimum level of public liability insurance is dictated by the regulation EC 785/2004 and is based on the aircraft’s weight. For most commercial drones, the legal minimum is 750,000 Special Drawing Rights, which equates to approximately £750,000. However, most professional operators carry significantly higher levels of cover, often between £5 million and £10 million, to provide comprehensive protection and peace of mind for their clients, especially when working on large-scale industrial or commercial sites.

What happens if I hire an uninsured drone pilot and there is an accident on my property?

Hiring an uninsured operator exposes you and your business to significant financial and legal risk. If an accident occurs causing property damage or personal injury, the liability could fall directly onto you as the client who commissioned the work. Without an appropriate insurance policy to claim against, you could be held personally or corporately responsible for covering all associated costs, from repairs to substantial personal injury claims. This is a primary reason to only work with a fully insured drone operator UK.

How is a drone operator’s insurance different from a photographer’s public liability insurance?

The distinction is critical. Standard public liability insurance, such as that held by a ground-based photographer, explicitly excludes aviation activities. Drone operations require a specialist aviation insurance policy that is compliant with EC 785/2004. This covers specific risks associated with flying an aircraft, including injury or damage caused by the drone itself. A photographer’s policy offers no protection for incidents involving an unmanned aircraft, making it entirely unsuitable and non-compliant for commercial drone work.

Can I check an operator’s CAA status online?

While the Civil Aviation Authority (CAA) does not have a public-facing database for instantly verifying an operator’s specific permissions, you can and should take direct steps. Always ask the operator to provide a copy of their Operational Authorisation certificate, which contains their Operator ID and outlines the scope of their permitted operations. A professional and legitimate operator will readily provide this documentation for your verification and peace of mind before commencing any project.

Does Impact Aerial operate with full commercial drone insurance?

Yes, absolutely. Impact Aerial operates with comprehensive commercial drone insurance that exceeds the minimum legal requirements set by the CAA. For our clients’ complete peace of mind, we hold a £10 million public liability policy, ensuring full compliance and protection for every project we undertake. We believe in absolute transparency and are happy to provide our insurance documentation and CAA Operational Authorisation certificate upon request, confirming you are working with a safe and professional insured drone operator UK.